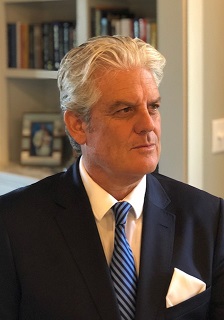

From the CEO – October 2022

Clients and interested parties often ask me about the various factors or driving forces that shape political risk, which happens usually during times of crisis or market turmoil. Being human – and always enjoying a good narrative – there is a tendency to overstate one or two causes or consolidate a nuanced event into a simple story based on, for example, a politician’s personality characterized by less-than-noble aims. These explanations are usually misguided. But all of us like stories, especially when they involve an official’s character. It’s almost too tempting to resist.

This is the stuff of the ‘talking heads’ that populate the media, and it serves the purpose of the media very well.

I was thinking of these types of stories when the UK media speculated that former PM Truss’ shelf-life would be akin to a head of lettuce. The Daily Star – a UK tabloid – came up with the comparison and given that she lasted all of 44 days at the helm the lettuce apparently won. Truss wasn’t well liked to say the least, and when the ‘mini-budget’ was unveiled shortly after assuming the PM’s job – a budget comprised of unfunded tax cuts and energy price controls – the bond and currency markets took flight, calming only slightly after the Bank of England intervened to prevent more forced selling by pension funds. Truss later canned her finance chief, adjusted her economic program to present some tax hikes on corporations, and then left the job.

As such, the UK bond and currency markets acted as stabilizing or corrective forces in the political risk game, obliging unpopular – and arguably less-than-prudent – politicians from their positions of power by creating conditions that make it near impossible for them to continue.

A good study that tests the impact and significance of country-specific and global explanatory variables on bond spreads across regions and economic periods was produced in an IMF Working Paper a little while ago. The question that the authors of the study sought to answer was whether the difference between the yield of a given emerging market sovereign bond and that of a US T-note of a comparable maturity – the sovereign bond spread – is appropriately priced in relation to the country-specific fundamentals of that emerging economy. If the sovereign bond spread stays at very low levels for long without reflecting the economy’s fundamentals, sudden shifts in the investors’ perception of risk may lead to sharp changes in the cost of external borrowing for that economy.

Using our ICRG political, economic, and financial risk data as pull factors in a baseline regression, the authors estimated sovereign bond yield spreads for 28 emerging market economies from January 1998 to December 2011. A similar regression was run to allow the dimensions of the panel to change for an improvement in the fitted bond spreads following a hypothetical positive change in the country-specific explanatory variables.

The results of the study were many, but one that stood out for the purposes of this piece was that a low degree of external vulnerability and a high degree of political stability can substantially reduce the cost of external borrowing. From a policy perspective, this underscored the importance of adopting measures that would reduce a country’s external vulnerability (e.g., issuing local debt to reduce external debt financing), or have in place strong institutions to foster political stability. (https://www.imf.org/external/pubs/ft/wp/2012/wp12212.pdf)

* * *

We continue to receive considerable demand for the newest addition to our popular Researchers’ Dataset series – one that offers clients a more granular look at the political risk components of the ICRG, supported by 20 years of monthly data. The new series works as an excellent complement to the other data bundles announced this year affecting ESG, corruption, and internal/external conflict. Scores of academic studies have been conducted using these series, providing unique insights in asset volatility, government responses to the pandemic, and many more. Contact us for more information.

As the month ended, Christopher had very enjoyable meetings with several African financial institutions, a litigation support and expert witness advisory, and with some branches of the US Federal Reserve. All lively discussions with some very talented individuals that explored the depths of the ICRG data series. Christopher is also looking forward to giving a keynote address later this year in Freetown to Sierra Leone’s annual meeting to discuss the country’s efforts to eradicate corruption, and to meeting with some colleagues later in DC at the International Anti-Corruption conference.

ICRG and related PRS data continue to be the gold standard of all geopolitical risk data among the scholarly community and increasingly so within the private investment world. Given the desire among new clients to find a geopolitical data series that separates the pure political risk component from a country’s overall risk profile, and thus avoid ‘double-counting,’ a land- mark study found the ICRG ratings to be indispensable. The study found that the ICRG ratings are easily incorporated into the valuation of an investment project by augmenting the project’s discount rate by the country’s sovereign spread. Viz, the project’s cash flows are forecasted in the absence of political risk events, which are then incorporated via an upward adjustment to the discount rate based on a country’s sovereign spread. (https://people.duke.edu/~char- vey/Research/Published_Papers/P122_Political_ risk_and.pdf)

Moreover, given concerns over central banks’ ability to tame inflation, a recent study using ICRG risk data considered the inflation targeting experience of emerging markets as ‘an effective monetary policy framework to promote changes in the currency composition of their international debt.’ It was found that ‘inflation targeting led to a 3-6 percentage point reduction in the foreign currency share of international debt in targeting countries when compared to non-targeting countries. (https://lnkd.in/gmPnf9S8)

Thanks for your continued support, and please contact us if we can be of any assistance.

Chief Executive