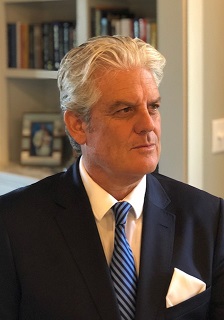

From the CEO – November 2020

Dear Clients,

The release of some positive news on the vaccine front in November was especially constructive for the emerging and frontier markets in our ICRG coverage.

Given concerns among many about the feasibility of storing the vaccines developed by Pfizer and Moderna (which require extremely low temperatures), the news that AstraZeneca’s shot can be refrigerated at more reasonable levels (and less costly to purchase) is especially welcoming to countries in less developed areas.

Moreover, emerging market valuations remain at relatively attractive levels and investors’ thirst for yield should continue to grow in 2021. Combine these features with what ICRG sees as a bottoming-out of risk in many emerging markets – especially in parts of Africa and Latin America – the case for long positions in a number of related asset classes is appealing. Brazil’s risk profile has continued to improve after hitting a two-year low in June. Both Mexico and South Africa have deteriorated of late which might signal some early and suitable entry opportunities. By extension, select emerging market currencies hold some moderate upside given longer-term weakness in the USD, buttressed by what would appear to be a continuing dovish stance by the new Fed Chair, Janet Yellen.

But the issue of sovereign debt sustainability remains concerning going into 2021. In Africa, in particular, a half-dozen countries (e.g., Congo Republic, Mozambique, Zimbabwe) are in ‘debt distress’ according to the IMF/World Bank criteria, while close to a dozen others are on the verge of sliding into that zone. The pandemic has caused Africa’s debt load as a percentage of GDP to rise by just under 20%.

To be sure, the G20 debt suspension initiative launched during the early months of the pandemic has helped relieve some of the pressure of repayments, and so too should the most recent announcement of a common framework that aims to help orderly treatment for those countries operating under the debt suspension program through collective creditor participation.

But much of the success of these efforts will depend on whether private creditors share some of the burden of the rescheduling (right now official bilateral lenders hold the bag), and there needs to be more involvement of the world’s development banks. Suggestions that the IMF’s Special Drawing Rights be used to add to a country’s international reserves (which would reduce their reliance on more costly domestic or external debt) hasn’t received much traction of late.

Because ICRG takes an autonomous approach to the risks associated with sovereign debt – and receives much information and guidance from its clients and others doing business in many emerging markets under its coverage – our ratings will continue to remain a vital source of guidance going forward.

Looking toward our ratings for the month, a number of countries stand out. In the Americas, Bolivia’s Arce won the first-round voting with 54%, and his party (MAS) holds a majority in parliament. The economy is in the tank. But the new president is seen as a ‘technocrat’ and views business favorably so far. Look for social spending to continue and perhaps a new deal with creditors in the future.

In Western Europe, France’s jobless rate sits at around 9% while tensions with the Islamic community continue to simmer. The approval ratings of Italy’s Conte have eased of late and protests surrounding the latest C19 lockdown have surfaced. Consumer confidence remains low and the outlook for local firms’ solvency is not terribly bright.

Hong Kong’s new anti-protest law was unveiled as Carrie Lam’s approval levels continue to be low. Beijing will continue to play an active role in the territory’s affairs, which should help keep a lid on social turmoil. In Myanmar, Suu Kyi’s party looks to have won a solid majority but a quarter of the seats in parliament remain reserved for the military, hampering true democratic reform.

In Africa, Cote d’Ivoire’s Quattara was elected by a landslide in a vote that was seen by many as questionable. And pre-election violence in Uganda continues over the arrest of Bobi Wine, an opposition presidential candidate. The January election looks set to be a democratic farce, and the EU says it might not send observers.

A Russia brokered deal to end the large-scale hostilities between Armenia and Azerbaijan has helped improve the risk profiles of both countries. However, Armenia has accused Azerbaijan of using cluster bombs since then, and 2,000 Russian troops are on the ground to enforce the deal.

Finally, in the Middle East, Algeria’s constitutional reforms have passed, giving the president more power but limits his time in office. The risk of terrorism should ease. And Libya’s talks for an interim regime should pave the way for next year’s elections. A ceasefire deal requires foreign forces and mercenaries to depart within three months. The country’s risk profile appears to have bottomed in July.

November was another solid month for new and returning clients, ranging from some of the world’s top universities to the largest institutional investors throughout the US, Europe, the UK, and the Middle East and Asia. For decades, PRS’ reach has been global, offering the absolute best quant-driven and independently back-tested data available anywhere.

The COVID-19 pandemic has kept us busy with continual adjustments to the economic forecasts and various political configurations. With risk profiles improving in many regions as the rollout of a vaccine looks increasingly likely during the early part of 2021, our clients have been especially attentive to the ICRG changes, and we’re happy to see such a devoted base and happy to accommodate the myriad questions.

We are pleased to announce some new products for 2021, including specific data bundles and more online and timely risk forecasts. The new data bundles will be especially useful for our academic clients as they are the most oft-used data series in published works in some of the most prestigious journals globally.

Quid Periculum? Managing Political Risk in an Age of Uncertainty, co-edited and co-authored by Peter Marber (Harvard/Aperture Investors) and me, is soon to be released. The book includes such diverse topics as risk forecasting techniques, reliability measures, the impact of political risk on asset prices and sovereign debt workouts. Also featured is a special roundtable discussion by some of the world’s leading voices in the field on the future of political risk, who combine to address some of the challenges presented by globalization and COVID-19. For more information and to reserve a copy of the book, please contact Louis Carroll, PRS’ Director of Business Development, at lcarroll@prsgroup.com.

We continue our discussions with the data analytics departments from several of our academic clients in the US, with the aim of providing the most comprehensive, AI-generated and back-tested data on geopolitical risk available anywhere. The effort pairs our internal work under the rubric of the PRS Artificial Intelligence Initiative, which we will soon make available to select clients. Stay tuned for more details.

PRS Private Client Advantage, which offers new and existing clients a greater diversity of data offerings and regular updates, consultations, bundled products, and more, is – judging from client demand – even more essential. Contact us for details. With the fluidity of the ratings, this benefit for clients is especially important.

Our ICRG political risk scoring changes were very robust in November, affecting some 70 countries (50% of our country universe) and over 90 individual risk metrics!!

Our ICRG data series continues to be the gold standard among the world’s leading academic researchers and multilateral organizations. In a recently published paper that assesses the relative importance of political risk on stock market volatility – using ICRG metrics – the risk of Government Stability was found to have a considerable influence on both stock returns and volatility irrelevant of the country. This was also true for volatility affected by the Socioeconomic Conditions. Investment Profile risk caused similar, significant shocks on volatility in such countries as Mexico, China and Iran, which suggests that trade in less developed countries tolerate more risk influence from other countries’ policy. Internal Conflict and External Conflict risk were found to exert an impact on returns in Mexico and Iran due to their own war history but no influence on volatility. (https://lnkd.in/dEzTGp4)

A number of ICRG risk metrics were identified as having a positive and close association with international bank flows, including Socioeconomic Conditions (unemployment, consumer confidence, poverty) and Investment Profile (security of contract, transfer risk, and payment delays), which presented an especially robust impact on fostering flows, especially after a financial crisis. (https://lnkd.in/d4bvEXR)

Thanks for your continued support, and please contact us if we can be of any assistance.

Chief Executive

PRS INSIGHTS

Moving beyond current opinions, a seasoned look into the most pressing issues affecting geopolitical risk today.

EXPLORE INSIGHTS SUBSCRIBE TO INSIGHTS