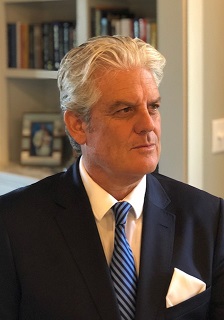

From the CEO – January 2021

Dear Clients,

Over the past decade, it’s been commonplace among those in the investment and multilateral communities to regard the traditional distinction between developed and emerging markets as irrelevant to modern, commercial times.

Unlike the 80s and 90s when the balance sheets of many emerging markets were less than stellar, incidents of debt moratoria were frequent, and government stability over an extended period of time was rare. As we moved into the new century the distinction became blurred: a good many emerging markets were on much better fiscal/monetary footing than their developed market cousins. When it came to larger geopolitical risks (e.g., Brexit, Trump’s presidency) it seemed that the non-emerging world held sway. The way in which many developed countries handled the continuing COVID-19 crisis – with some of the worst infection and fatality rates globally – the early assumption about emerging markets being riskier than developed ones became both arguable and notably issue-specific.

Specificity is important here since it helps color the distinctions noted at the outset. As the rollout of the vaccines continue, the concern is that some less-wealthy countries will not be able to quickly and adequately immunize their populations, resulting in a variety of political risks surfacing over time. These range from higher levels of social disorder (as we are seeing in Tunisia, as an example), to more authoritarian regime tendencies (e.g., China, Myanmar). Add these to the not-unrealistic risks posed by strained balance sheets, higher taxes/end of subsidies, debt-servicing problems, the overall outlook for the emerging market asset class is not terribly bright at the moment. Selecting the right country exposure, based on a series of metrics, including political risk, is therefore vital.

To be sure, some of these risks – especially those generated by COVID-19 – are not exclusive to emerging markets. As I was finishing this note, riots erupted in several European countries over lockdown measures, including Austria, Belgium, and Hungary. Hospitality workers have been especially hard hit by the various measures, and our ratings reflect the view that such disturbances will continue over the next couple of months. Instructively, it will be recalled a study published last fall by the IMF Working Paper series that found – using our ICRG data – of the 133 countries considered from 2001-2018, when centering on the effects of pandemics unrest surged about 14 months after the onset of the disease, peaking after 24 months. We still have some time to go, it would seem.

On the much-discussed idea that COVID-19 worked to help derail the process of globalization that many began talking about even before the pandemic hit. According to UNCTAD’s latest Global Investment Trends Monitor released last October, FDI flows fell by about 50% during the first half of last year compared to 2019. Developed economies were hit especially hard, where year-on-year flows declined by some 75%. On the other hand, FDI flows to emerging market countries fell 16%, largely due to investment continuing in China. Indeed, during the six months to June 2020, emerging markets in Asia accounted for more than 50% of global FDI flows.

Underlying these trends is the prospect of an economic recession – induced by the pandemic – worked to shelve the plans of multinational firms in their plans to expand abroad, the effect of COVID-19 has also done much to disrupt global value chains and help usher in new regulations affecting foreign investment.

One area where the idea of globalization is not in retreat would be in the work of the multilaterals, such as the IMF and the World Bank. Notwithstanding their vital lending during the early days of the pandemic, for the first time in some time, both of these organizations appear to be leading the way on the basis of data collection and dissemination. They also seem to be ahead in terms of thinking about the current and post COVID-19 world, and in particular the research on the impact of the pandemic on various economic and political phenomenon. Clearly, as debt-to-GDP levels have risen substantially over the past year, and as the Fund has underscored in recent posting, some highly indebted emerging market and developing economies ‘are starting to find it more difficult to born to support the response to the pandemic.’ Over the next several years, the role of the IMF and other lending bodies will become increasingly important.

Turning to our ratings for the month, a number of countries stand out. In the Americas, Chile’s central bank has purchased swaths of USD to curb the peso’s upward trajectory and bolster reserves ahead of some borrowing later this year.

Peru’s next election is set for April. And while we expect President Sagasti (who, from personal experience, is a very reasonable and learned gentleman) to remain in office until then, overall stability is questionable given that the current list of presidential candidates doesn’t appear to inspire much public admiration. Look for mining supply lines to be blocked occasionally and for isolated protests to continue.

In parts of Europe, Italy’s government collapsed – as was largely expected – so all eyes are now on coalition building and especially the next moves of Italia Viva. The government also resigned in the Netherlands over a benefits scandal, and an election is set for March. Like some other European nations, incidents of social turmoil in reaction to the latest lockdown measures will continue until the number of cases ease and mobility restrictions relaxed.

Elsewhere, the government in Kazakhstan won the January election with 71% support, and reform efforts going forward will be designed to ensure an orderly succession of power. Russian protests continued over the arrest and detention of Navalny’s detention, so Putin’s challenge will be to diffuse the discontent ahead of the parliamentary vote this year.

Over in Asia, Malaysia’s parliament and elections have been suspended and a state of emergency has been issued. Controlling the spread of COVID-19 was the pretense for the move, but PM Muhyiddin’s grip on power has been under threat and tensions are simmering within governing party. Mongolia’s government also quit (it’s handling of the pandemic there was the main factor) and elections are scheduled. We don’t see the current interim cabinet being terribly stable.

Note that we are also watching the situation unfold in Myanmar. Our risk numbers affecting the involvement of the military and the extent to which the government of Suu Kyi posed a challenged to the generals were reflected in our risk profile of the country, so the coup shouldn’t come as a complete surprise to our clients.

Finally, in the Middle East and Africa, terrorism risk is up in Algeria; Tunisia appears to be experiencing a new Arab Spring; and Zimbabwe’s PM lost a confidence vote but refuses (to now) to vacate the post, claiming that the tally was tantamount to ‘overthrowing’ the regime. For now the country’s reform agenda is on hold and the role of the military is key. Speaking of security forces, following the re-election of President Museveni in Uganda, opposition calls for protests have been effectively dampened by that country’s armed forces.

In other events, as many know, PRS/ICRG is one of a handful of firms supplying corruption data to Transparency International for the organization’s annual Corruption Perceptions Index, which was released on 28 January. New Zealand and Denmark came out on top; Somalia and South Sudan were at the bottom. Many countries dropped in the ranking since last year, including Canada and the US. Indeed, the US now sits at 25 of 180 countries, below France, Ireland, Japan, and a host of Western European countries. Note that our ICRG corruption data is consistently back tested for relevance and has been shown to display a statistically significant relationship with economic growth.

January was another stellar month for new and returning clients, ranging from some of the world’s top universities to the largest institutional investors throughout the US, Europe, the UK, and the Middle East and Asia. ICRG is now being used by one of the world’s largest technology firms and is decisively rooted in the artificial intelligence/machine learning space.

We are also delighted to announce the continuing rollout of products for 2021, including specific data bundles and more online and timely risk forecasts. The new data bundles will be especially useful for our academic clients as they are the most oft-used data series in published works in some of the most prestigious journals globally.

Quid Periculum? Measuring & Managing Political Risk in an Age of Uncertainty, co-edited and co-authored by Peter Marber (Harvard/Aperture Investors) and me, is set for release next month! The book includes such diverse topics as risk forecasting techniques, reliability measures, the impact of political risk on asset prices and sovereign debt workouts. Also featured is a special roundtable discussion by some of the world’s leading voices in the field on the future of political risk, who combine to address some of the challenges presented by globalization and COVID-19. For more information and to reserve a copy of the book, please contact Louis Carroll, PRS’ Director of Business Development, at lcarroll@prsgroup.com.

Our ICRG political risk scoring changes were very robust in January, affecting some 63 countries (of 140) and over 88 individual political risk metrics!!

Our ICRG data series continues to be the gold standard among the world’s leading academic researchers and multilateral organizations and the data are yielding some interesting findings as the impact of the pandemic continues. In a recent IMF Working Paper that used our ICRG data in part, the lockdown initiated by most governments to contain the virus forced many public bodies to switch to online platforms in order to continue to provide services. The question is whether e-government could enhance a country’s locational advantages and attract more direct inflows. Looking at 178 countries from 2003-18, the results suggests such efforts did indeed stimulate FDI.

(https://lnkd.in/ehi8q9y)

Thanks for your continued support, and please contact us if we can be of any assistance.

Chief Executive