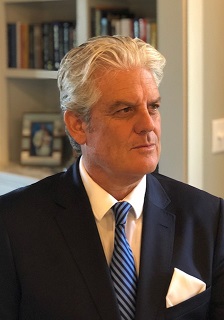

From the CEO – August 2021

Dear Clients,

Dear Clients,

At first glance – and given the media treatment of the events in Afghanistan over the past several weeks – the trajectory of political risk in that country doesn’t appear to be too promising. Indeed, since most in the political risk business today were far too young to be affected by the events of 9-11, for the first time in some time the world now seems to have a terrorist nation making its return to international affairs.

To be sure, PRS’ clients know from our risk ratings that al-Qaeda and other jihadist movements have been active for some time in the African Sahel and parts of Asia and the Middle East. Some of these groups’ efforts will affect Western interests directly. But the indirect results of these conflicts will be equally significant (e.g., refugee movements across borders). These are the items that bring about more widespread and nuanced instability.

I raise the terrorism issue for two reasons. First, with Afghanistan, the withdrawal efforts by the US and other allied nations has created a degree of uncertainty that is now the discourse politique among intellectuals and bureaucrats, as well as political fodder for the media and the political class in DC and internationally. Not surprisingly, despite the troop departure being put in motion under Trump’s presidency, Biden is getting the heat for the less-than-smooth evacuation of US personnel, with his approval ratings taking a significant hit over the past week.

Second, the notion of terrorism – and here I define it generally as violence committed by organized, non-state actors for political or economic, or religious purposes, designed to have far-reaching psychological effects beyond the immediate target – associated with Afghanistan and other countries also must be put into context, and driven by data. Media reports focus on fear and single events and use the emotions that are consequently produced to create and monetize readership. Daily unfolding megatrends of progress rarely make the headlines, yet they are important for strategy and decision-making.

One of the key chapters in our new book, Quid Periculum? Measuring & Managing Political Risk in the Age of Uncertainty, is a chapter by Max Roser and his team at Oxford University, titled: ‘Terrorism Risk: Perception, Reality, and the Importance of Data.’ Using data collected from his seminal Our World in Data (OWID) project, the chapter notes that the frequency and severity of terrorist risk are far less than what might be perceived.

Some examples will suffice: From 1990 to 2017, the global share of terrorism against total deaths from all causes was less than 0.01% in 2002 (a low point) to just over 0.08% in 2015 (a high point). The Middle East and South Asia experience the most terrorist acts (roughly 95%); North America and Europe had only about 2% of the incidents combined. In terms of the US experience, except for the deaths from the 9-11 attacks, there were more fatalities from terrorist attacks in the 1970s, although globally the data showed that there was a steady but small increase in such incidents from 2015 to 2017 (for e.g., Paris attacks, the London Bridge bombing).

Interestingly, when considering what determines the amount of media attention a terrorist attack receives, it seems that if the incident is perpetrated by a Muslim the coverage is far more extensive than it would be based on the number of people killed. Moreover, in terms of the things that could kill us, terrorism is far more overrepresented in the news media than such maladies as cancer and heart disease, which wipe out far greater percentage of people annually.

So as the media coverage of Afghanistan continues – and as warnings of potential terrorist attacks outside Afghanistan will likely begin to circulate within the media news cycle – from a risk perspective, such findings are instructive.

Turning to July’s ratings a few standouts are worth mentioning. In the Americas, a tight election campaign has emerged in Canada, where PM Trudeau’s Liberal Party appears to be facing a much-reduced minority government after September 20th. The PM has faced mild protests and a mild (as of now) 4th wave of covid infections. Over in Cuba, last month’s protests have eased as the government has permitted private SMES to operate. However, the new monetary system has produced non-insignificant levels of price inflation.

In Western Europe, in addition to a noticeable trend of plateauing and falling consumer confidence levels in many countries, protests continue in the Czech Republic against PM Babiš. The PM and his ANO party still lead the public opinion polls with a parliamentary vote set for October 8th. In Poland, C19 cases have flattened but anger has surfaced over the passage of a law that prevents property owners, including Holocaust survivors and their descendants, from regaining property expropriated by the country’s communist regime. A controversial media law also forced a junior coalition partner from the governing body, raising the specter of an early election.

Over in Eastern Europe, Bulgaria’s new government is in place but it’s fragile and not expected to last very long. C19 cases and anti-vax protests are rising, too. Moldova’s parliament has approved a pro-EU cabinet while trade resumes with Russia. C19 cases are on the rise.

Madagascar’s risk profile has been undermined recently by an assassination attempt, and famine in the southern parts of the country. Elsewhere in Africa, a more positive note was struck in Zambia as long-time opposition candidate, Hakainde Hichilema, won the presidency with roughly 60% of the vote. The new leader is emphasizing more spending for infrastructure and acts to reduce corruption. The country’s currency and dollar bonds surged on the win.

In Asia, Australia’s political risk profile has deteriorated with the spread of the Delta variant, lockdowns and protests, and an approval rating for PM Morrison that is now at its lowest point since prior to the pandemic. Consumer confidence has fallen off, too. In Mongolia, there are concerns about the overall health of the country’s democratic institutions as the consolidation of power in the hands of the MPP is pushing the country towards a hybrid single party regime.

Finally, in the Middle East, Algeria’s political risks have risen on the back of terrorist incidents, mob killings, and dissent being crushed quite effectively by state security forces. And in Morocco, in an incident reminiscent of that which set off the Arab Spring a decade ago, protests followed an act of self-immolation by a merchant in the city of Sidi Bennour, who was assaulted by police and the authorities took away his food cart. The merchant died of the injury.

August was another dynamic month for new and returning clients, ranging from some of the world’s top universities to the largest institutional investors throughout the US, Europe, the UK, and the Middle East and Asia. Our data are now regularly featured in the research of the IMF, Bank for International Settlements, and various central banks, such as the Bank of Italy.

We are also pleased to have concluded our preliminary assessment of Uzbekistan’s risk profile for the Finance Ministry with our most recent data to bring that country into the ICRG fold and have it ranked alongside the 140 countries contained in the index. We are also pleased to have been invited to ministry’s upcoming economic conference titled: “Uzbekistan: Achievements of economic reforms and outlook” in Tashkent in September. Look for Uzbekistan to make its ICRG debut very soon.

The new look of PRS is coming soon, too. Paying homage to our roots in the Hindu Arabic number system of the Renaissance period to more recently in the behavioral revolution of the late 1960s, one of our new features will be a regular podcast series, featuring interviews and discussions with some of the most distinguished practitioners and academics in the field of geopolitical risk, from such places as Saudi Arabia, Uzbekistan, the UK, and Dubai. No other podcast series will offer such depth, relevance, and intellectual sophistication. Stay tuned.

Not only is ICRG being used by some of the world’s largest technology firms, but the data are now being incorporated increasingly into the artificial intelligence/machine learning space, with an emphasis on ESG data! On this score, we are especially pleased that our data are being used by an increasing number of institutional investors as the empirical connection between our select risk indicators and various asset classes become more pronounced and tradable. Be sure to contact us for our select ESG data bundles.

Our ICRG political risk scoring changes were very robust in August, affecting some 85 countries (of 140) and over 120 individual political risk metrics!!

ICRG and related PRS data continue to be the gold standard of all geopolitical risk data among the scholarly and research communities. A recent study from the Bank of Italy’s Working Paper series looked at the effect of global and domestic factors on capital flows towards emerging markets over the past quarter century. To be sure, the Fed’s stance has been key. But so have various push and pull factors, including country risk (as proxied by our ICRG composite scores). (https://www.bancaditalia.it/pubblicazioni/temi-discussione/2020/2020-1262/index.html?com.dotmarketing.htmlpage.language=1).

Another recent study found an inverse relationship between our ICRG Law and Order risk metrics and the depth and liquidity of a country’s bond market? (https://www.nber.org/papers/w10576).

Thanks for your continued support, and please contact us if we can be of any assistance.

Chief Executive