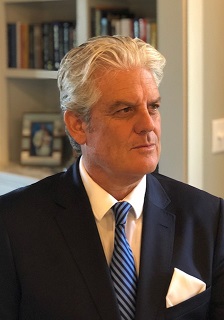

From the CEO – January 2020

Dear Clients,

One of the questions I’m often asked when meeting new entrants to the field of political risk is: What does the future hold for this type of work? Compared to the time when I entered the industry shortly before the Asian financial crisis, the number of firms specializing in ‘geopolitical’ risk analysis has multiplied considerably, and the ways in which political risk affects our lives are much clearer now. So the ‘food’ for the answer is abundant, so some general observations can be made.

Much of the attention of political risk practitioners and scholars has been shaped by events of the times – which, of course, is really the case in most affairs. The Asian financial crisis shifted attention largely away from some of the plain vanilla political risks of years before (e.g., Cuba-styled asset expropriation by the state) to the risks created by large private current account deficits, fixed exchange rates and easy credit that fostered unsustainable foreign borrowing. The events of 9-11 spawned a plethora of Middle East experts and those specializing in the multifaceted nature of terrorism. The global financial crisis of 2007-2008 shifted the attention to capital and liquidity issues. And the increasing sophistication of information technology and advanced warfare created specialists in cybersecurity and the like.

The geographic focus also shifted over the years, from Asia to the Middle East as the century closed out and a new one began, to Latin America during the commodity boom years of the mid-2000s, to the now universal recognition that developed markets are just as risky (but for sometimes different reasons) than emerging and frontier markets.

Artificial intelligence and machine learning applications have ushered in a new age. And with it, a new – and much more rewarding – focus for political risk.

To be sure, our thinking about artificial intelligence dates back some time. Robots and other self-moving objects appear in the works of the ancient Greeks. One well-known example is the story of Talos: a giant man-made of bronze who was commissioned to protect the island of Crete by throwing rocks at invading ships. Talos had a tube running from his head to his feet – it was his life source that the Greeks called ichor. By one account Talos met his demise when the sorceress Medea removed a bolt at Talos’ ankle, allowing the ichor fluid to drain.

Significantly, the Greeks also left us with a way of thinking that has endured over time, and in some way underscores much of the rationale and utility of AI.

Socrates, for example, was one of the first to second guess commonly held beliefs, discerning those that are logical from those that were lacking a rational foundation, notwithstanding how comfortable they might be or whose interests they might serve.

Thomas Aquinas’ Summa Theologica pushed Socrates’ tenants further, joining reason to thought, which was later expanded to almost every dimension of human endeavor, from art to law, to notions of freedom, notably during the Renaissance of the 15th and 16th centuries. Rene Descartes developed a way of thinking critically based on the principle of systematic doubt so that almost every aspect of thought should be subjected to scrutiny and tested.

While much ink has already been spilled on the subject, it seems inevitable that AI will permeate more and more industries and assume tasks that people once performed in a more effective and efficient manner. From agriculture (where labor shortages are clear) to education. From cybersecurity to cloud hosting. Operations are being streamlined and decisions are being informed in a substantive fashion.

The investment industry has not been immune to these changes. Some ETFs use AI algorithms to select security holdings over a long-time horizon. Other investment houses use large streams of data to create tailored portfolios. While others use AI to define patterns that might not be found by humans to pinpoint and exploit non-intuitive relationships between securities and market indicators. All these approaches play a supporting role in the investment process and decision making that goes on therein.

Under these conditions, several years ago I began to wonder if PRS/ICRG data could yield some interesting results if subjected to a range of AI/machine learning applications. After all, our data have been back-tested for relevancy and accuracy since the early-1990s, and the findings for investors and for those interested in how political risk affects a range of relevant financial, economic and political phenomenon is extensive.

We contacted a university-based data analytics group to run some preliminary tests. We supplied them with a sample data series based on the ICRG composite risk scores. Within a few weeks, a short summary of the findings was provided. It was a start, to be sure: correlations between risk metrics and countries were found. Our data series was able to be brought forward by year with confidence intervals around 80%. Some of the findings were intuitive, while others were thought-provoking.

With time we were approached by a VC group, backed by a number of very well-known asset managers and hedge funds/family offices in the US and the UK. Their idea was to combine PRS’ political risk data with other data and present a professional-grade analytics platform that used AI and computational technologies to deliver insights to and augment the skills of discretionary asset managers in a timely fashion.

Over the last several months the results have been coming in and they are – unashamedly – truly revolutionary. PRS’ country political risk scores are generating signals of price rallies in various asset classes, as well as currency pair trades. The success of the signals are made clear with each trade ‘episode’ along with a range of median returns. ‘Walk-forward’ out of sample backtesting is conducted to remove look-ahead bias.

An official announcement of the partnership will be made very shortly, so stayed tuned and feel free to contact the NY office of PRS (315-431-0511) if you would like to learn more about this exciting new beginning in political risk analysis.

Turning to our country coverage this month, some highlights from the changes in risk scores are worth noting. In the Americas, Argentina’s debt workout talks are stalled for the most part, while consumer confidence has registered a slight uptick. The central bank is introducing more liquidity into the country, and Argentina is now nearing the upper band of ICRG’s “Moderate Risk” category.

In Western Europe, recent regional elections disappointed far-right/Salvini supporters, as leftist parties continued to hold electoral sway. In Denmark, while overall political stability is fine, and the government should serve out its full term, currency weakness and deteriorating FX reserves have caught our eye. The country still has about 7 months of import cover and the situation should really be a temporary one.

Over in Africa, Cameroon’s ruling Rassemblement démocratique du peuple camerounais should lose some seats in the upcoming February vote, but its continued legislative majority should dampen policy risk. We are telling our clients not to expect a clean tally, and violence and low turnout should be expected. Watch subsequent talks with Anglophone communities and efforts (remote, however) aimed at a purer federal state.

In Guinea Bissau, Embaló, a former PM and military officer, captured the recent run-off presidential contest. Unsurprisingly, the losing ruling party said it will contest the outcome. ECOWAS declared the vote to be OK, and military support is available if the post-election climate turns sour.

In Asia, the coronavirus has done nothing to improve China’s overall risk profile. Businesses are closing operations; commercial flights to China are being suspended. Russia just closed its border with China. The WHO will decide shortly whether to declare a global emergency. Chinese and HK stocks have been hammered.

In Eastern Europe, Kazakhstan’s Tokayev has tightened the presidency’s grip over state security forces. The country has about $160 bn in external debt. Business confidence and FX levels returning. The government has made commendable efforts to address draft in public affairs and in the business climate. The introduction of a common-law commercial court has been especially welcomed by foreign investors.

Finally, in the Middle East, inflationary pressures in Syria are mounting as the currency slides on parallel market. Reconstruction continues in regime-controlled areas. Some areas of Aleppo are also being repaired, providing a boost to local economy.

Support continues to grow for Turkey’s Erdogan and his regime, despite the country’s economic woes. The central bank has continued to cut the policy rate, but consumer confidence remains low. FX reserves amount to about 4 months of cover.

We would like to welcome some new and returning clients this month, including Aperture Investors, AQR Capital Management, Baylor University, Princeton University, Repsol, the ECB, and Robeco. Thank you so much for your (longstanding) support!!

I had a very enjoyable meeting with EMTA Miami in mid-January and I look forward to the next gathering in NYC in February where the focus will be exclusively on Argentina.

Next week I will be in Riyadh, speaking at a G20 side event of the first Anti-Corruption Working Group. Addressing graft through data and measurement will be on the table. Later, I will be a guest speaker at the College of Charleston’s 6th Annual Strategic Investment Symposium in March. I’ll address the interface between quant-generated political risk and investment, and be joined by specialists from JP Morgan, Wells Fargo, Goldman Sachs, and Evermore Global Advisors.

Our data is now the world’s leading quant-driven geopolitical risk data, used by investors with over $20 trillion in assets under management.

The academic community continues to use and test our data. One recent study used our ICRG political risk measures to highlight its importance to the determination of bond spreads.

Others have found evidence that ICRG’s political risk measures affect stock returns of developed, emerging and frontier markets, but the effect of individual components of ICRG differs according to the market category. The common source of political risk that is significant in all three market categories is Government Stability, Socioeconomic Conditions, and Investment Profile. The main difference relates to the risk of conflict reflected in Ethnic Tensions (relevant only in the frontier and emerging markets categories). Finally, the source of political risk that is unique to frontier stock markets is Government Stability.

Thanks for your continued support, and please contact us if we can be of any assistance.

Chief Executive